Whether your business is the new, brief, persisting Columbus installment loans no bank account for some time or perhaps not actually started but really, sometimes delivering financing to suit your needs feels as though purpose impossible. But not, there are many investment possibilities to your entrepreneurs. Certainly one of all of the resource possibilities crowdfunding is the brand new one, that has got massive dominance in the last very long time.

Generally speaking, that have many choices is an excellent thing, but that have too many alternatives is not adequate to suit your needs. You ought to figure out what’s right for you as well as your business and that will enchantment minimal troubles for your requirements. We be aware that 70% of your own businesses falter within the very first phase, the reason is not enough loans nevertheless the possibility of inability persevere despite getting fund, it could be due to shortage of dealing with experiences otherwise incorrect choice regarding the capital option. This occurs as much businesses failed as they got stuck paying back a loan which they didn’t manage.

Crowd Financial support or Small business Mortgage: Which is Best for Your organization?

One of several the new capital choice, crowdfunding is the one that’s getting huge dominance these days. The fresh crowdfunding markets experienced an increase by the 167 per cent in the world when you look at the 2014, with $sixteen.dos billion raised. In this post we’re going to understand crowdfunding, and you will just what it shall be for your needs. You could see during the an easier way on condition that might examine it with a traditional business financing, as the majority of all of us understand the business loan and many people need actually preferred it.

Group computing was a funding choice to the company citizens thanks to which they may funds for their organization effortlessly. Here fund are supplied of the multiple individual, your method a lot of people over the internet getting money. You have got to establish their tip and you can strategy for your online business. If someone see it wort to blow on your organization it provides you with funds. There are many different websites where you can approach such people exactly who can invest in your online business. Contrary to the funds, you have got to render certain security in your providers otherwise some profit margin.

Difference in Crowdfunding and you will Home business Financing

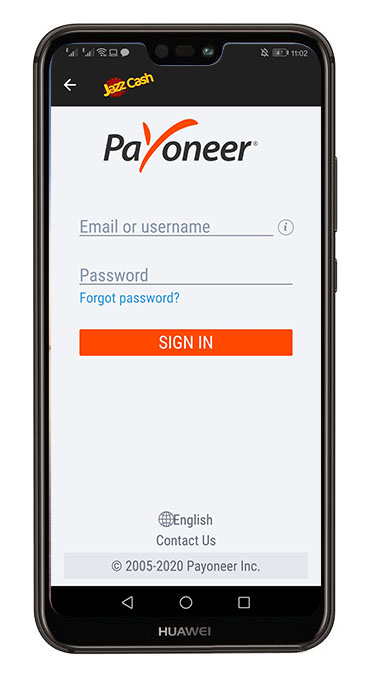

You have made a small business mortgage either away from a lender or an enthusiastic NBFC, it’s also possible to apply for it on the internet from the financial site or truly of the supposed lender.

But when you are looking at Crowdfunding Financing was approved from the crowdfunding platform, nevertheless the currency arises from numerous individuals otherwise teams.

When you’re for a corporate financing off any of the banks they’re going to discover your credit score, bank’s report, ITR immediately after which business plan and you can method they are going to and additionally ask for any other ongoing mortgage for you. Clearly there are of several qualifications criteria hence, will eventually it can be hard for you to receive a business financing.

you go for a beneficial crowdfunding for your business you will find zero particularly qualifications criteria. What is important required to get financing due to crowdfunding is a good business strategy and therefore best of procedures so it is notice all the crowdfunding professionals to invest in their campaign.

However, crowdfunding does not have any reference to the credit score, you can purchase fund because of crowdfunding even though you possess reduced CIBIL.

With respect to paying a business financing, you can certainly do so by settling it from inside the monthly instalments recognized just like the EMI. Alternatives for example prepayment and you may part fee can also be found by way of which you are able to pay-off your loan. There are a few penalties and late okay when you’re today capable repay the loan according to agreement.

But if you o for a crowdfunding you don’t need to shell out EMIs facing your loan to own cost. You will want to support the vow you built in the latest arrangement such as discussing guarantee or sharing profit margin.

When you acquire out of a bank otherwise a keen NBFC it fees particular portion of notice on the credit that is a whole money on them.

Professionals If you get entitled to a business financing, you have got a guaranteed mortgage to you which you have to repay that have regular costs i.e. EMI. You don’t need to out of offering guarantee on the market so you can a 3rd party.

Issues That have business funds you have strict lending requirements and also in words to be eligible for they you have to complete the qualifications standards, which is hard to be eligible for all of the. It takes an extended process and you will extended in order to the loan to locate disbursed on your own membership.

Experts crowdfunding has the ability to carry out loads of tool buzz prior to this new launch of the product so because of this is also interest investors. One can possibly slope for it and you can obtain resource.

Dangers crowdfunding reveals your organization means and you may bundle you have produced for your needs causing your online business plan to feel public. Among the other drawbacks regarding the your own tip is going to be duplicated and used by one 3rd party.